accumulated earnings tax c corporation

To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. This is because corporations that do not spend retained earnings are.

Earnings And Profits Computation Case Study

According to the IRS anything.

. The accumulated earnings tax rate is 20. May 17th 2021. For C corporations the current accumulated retained earnings threshold that triggers this tax is 250000.

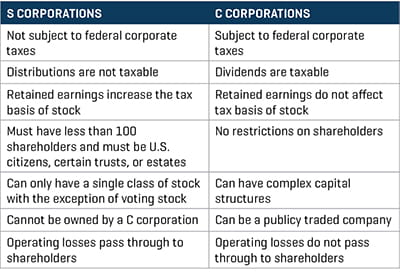

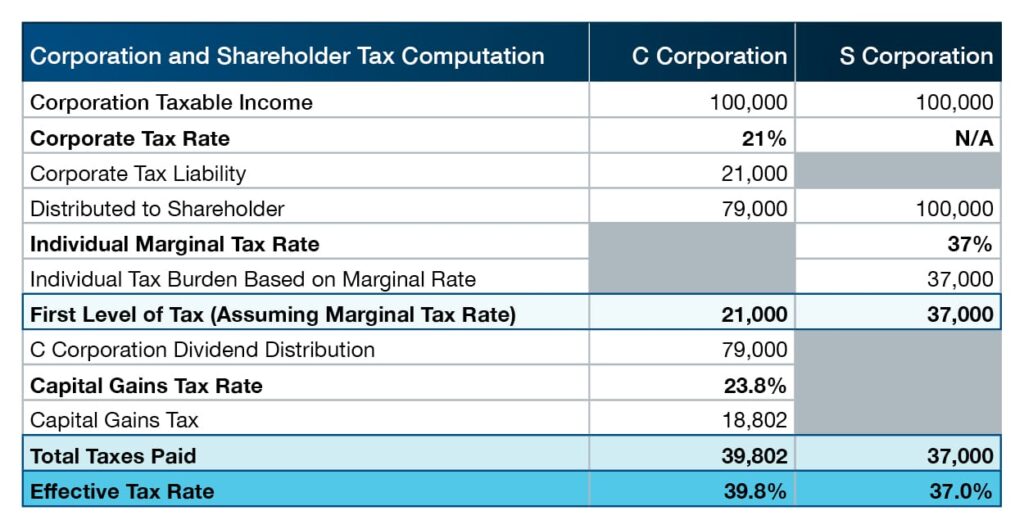

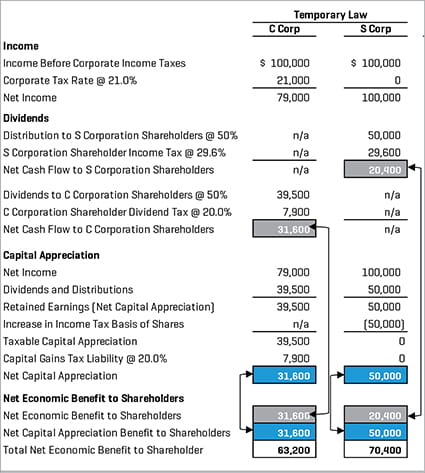

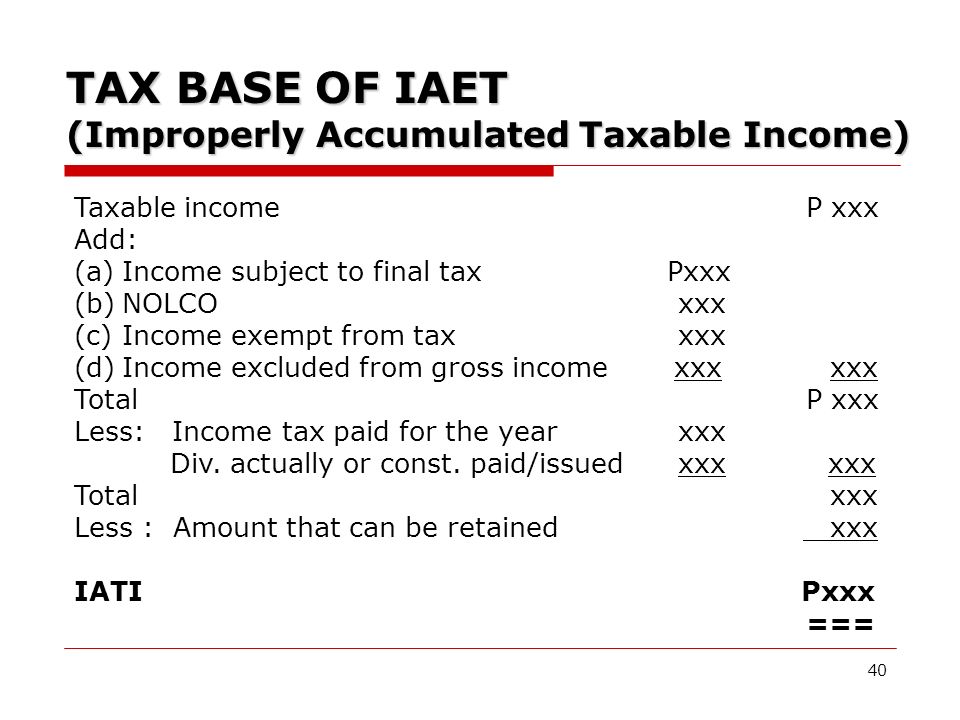

As the difference between ordinary income tax rates and capital gains tax rates increases corporations have sought to minimize dividend payments to shareholders with the objective of helping them secure capital gains taxed at a lower rate. There is a certain level in which the number of earnings of C corporations can get. The accumulated earnings tax is considered a penalty tax to those C corporations that have accumulated over 250000 in earnings 150000 for PSC corporations and if that excess amount has not been distributed to shareholders in the form of a dividend.

The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. The threshold is 25000 without accumulated earning tax. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

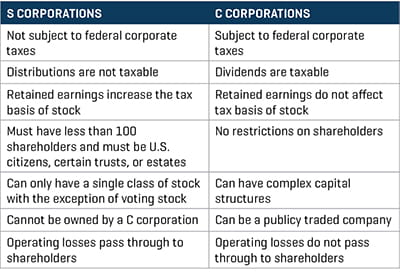

Private and publicly held corporations are subject to this tax but it does not impact passive foreign investment companies tax-exempt organizations and personal holding companies. Accumulated Earnings Tax The AET is a 20 percent tax for each tax year on accumulated taxable income of corporations1 While the AET hasnt been widely imposed or litigated in recent years it still applies to all corporations with limited exceptions2 formed or used to avoid the individual income tax. TaxAct Business Tax Filing Prioritizes Your Security Helps Maximize Your Deduction.

Typical C corporations where shareholders are taxed separately from the company may retain up to 250000 of their earnings before. The IRS also allows certain exemptions based on the required. Exemption levels in the amounts of 250000 and 150000 depending on the company exist.

The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. Affordable Tax Filing Made Easy. However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to.

When the revenues or profits are above this level the firm will be subjected to accumulated earnings tax if they do not distribute the dividends to shareholders. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and profits to accumulate rather than being paid out. The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income.

As a practical matter the tax is col-. S corporations that have accumulated. By CORY STIGILE Posted by Hochman Salkin Toscher Perez PC.

Ad Free Tax Filing Help. Its purpose is to prevent the accumulation of earnings if the reason for such is for shareholders to avoid paying taxes by not paying dividends. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

With 100 Accuracy Guaranteed. EP generated in a C corporation are subject to two levels of taxation corporate and shareholder and retain this character even if subsequently owned by an S corporation. If a C corporation retains earnings above a certain amount the corporation may be assessed a tax penalty called the accumulated.

He accumulated earnings tax AET is imposed by Internal Revenue Code IRC section 531 on C corporations formed or availed of for the purpose of avoiding the imposi-tion of income tax on their shareholders by permitting earnings and profits to be accumulated instead of being distrib-uted. Tax Notes -Now I Am a C Corp. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation.

The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue Code. It is presumed that a corporation can retain up to 25000000 or 15000000 for certain service corporations for the. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being divided or distributed.

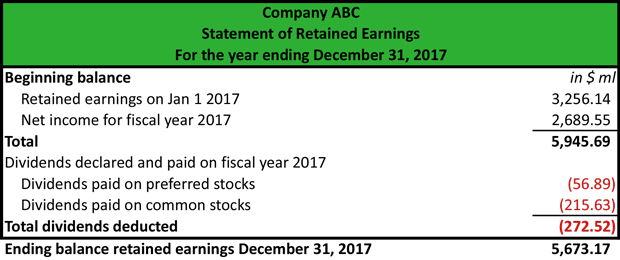

Section 535c3 provides that in the case of a mere holding or investment company the accumulated earnings credit shall be the amount if any by which 150000 100000 in the case of taxable years beginning before January 1 1975 exceeds the accumulated earnings and profits of the corporation at the close of the preceding taxable year. Accumulated EP was taxed at the C corporation level and will be taxed again as a dividend to recipient S corporation shareholders when distributed. Posted on Wednesday May 15 2019 In this article Cory Stigile provides background on the accumulated earnings tax and explains the steps corporate taxpayers may be able to take if the government begins to more.

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. What About the Accumulated Earnings Tax. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

Breaking Down Accumulated Earnings Tax. The tax is assessed by the IRS rather than self-assessed by the taxpayer. What is the Accumulated Earnings Tax.

REASONABLE NEEDS OF THE BUSINESS. Accumulated Earnings Tax is a corporate-level tax assessed by the IRS. The tax is assessed at the highest individual tax rate on the corporations accumulated income and is in addition to the regular corporate income tax.

The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the business the corporation may be assessed tax penalty called the accumulated earnings tax IRC section 531 equal to 20 percent 15 prior to 2013 of. How the accumulated earnings tax interacts with basic C corporation planning Choice-of-entity planning involving C corporations often revolves around a plan to operate a business through a C corporation to take advantage of the low 21 federal corporate income tax rate retain earnings in the corporation by minimizing compensation and dividends and.

Earnings And Profits Computation Case Study

Demystifying Irc Section 965 Math The Cpa Journal

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Strategies For Avoiding The Accumulated Earnings Tax Krd

S Corporation Or C Corporation Under The Tax Cuts And Jobs Act Pya

What Are Accumulated Earnings Definition Meaning Example

Determining The Taxability Of S Corporation Distributions Part Ii

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Earnings And Profits Computation Case Study

Oh How The Tables May Turn C To S Conversion Considerations Stout

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Oh How The Tables May Turn C To S Conversion Considerations Stout

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

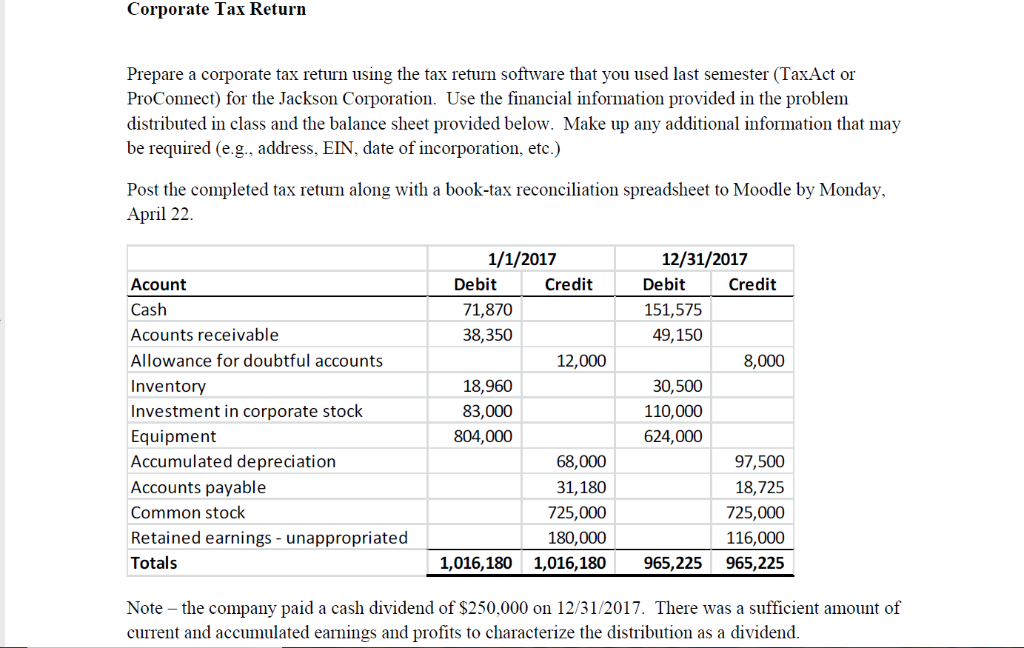

Corporate Tax Retur Prepare A Corporate Tax Return Chegg Com